Page 140 - Annual Report 2017

P. 140

| 140 141 |

Standards issued but not yet effective IFRS 9 Financial Instruments (b) Impairment The QFC Regulatory Authority plans to adopt the new standard on

The standards and interpretations that are issued, but not yet effec- In July 2014, the IASB issued the final version of IFRS 9 Financial IFRS 9 requires the QFC Regulatory Authority to record expected 1 January 2018, mandatory for financial years commencing on or

tive, up to the date of issuance of the QFC Regulatory Authority’s Instruments that replaces IAS 39 Financial Instruments: Recognition credit losses on all of its terms deposits, accounts receivables. The after 1 January 2018.

financial statements are disclosed below. The QFC Regulatory and Measurement and all previous versions of IFRS 9. IFRS 9 brings QFC Regulatory Authority will apply the simplified approach and IFRS 16 Leases

Authority intends to adopt these standards, if applicable, when together all three aspects of the accounting for financial instru- record lifetime expected losses on all account receivables and

they become effective. IFRS 16 was issued in January 2016 and it replaces IAS 17 Leases,

ments project: classification and measurement, impairment and general approach to determine credit losses on terms deposits. IFRIC 4 Determining whether an Arrangement contains a Lease,

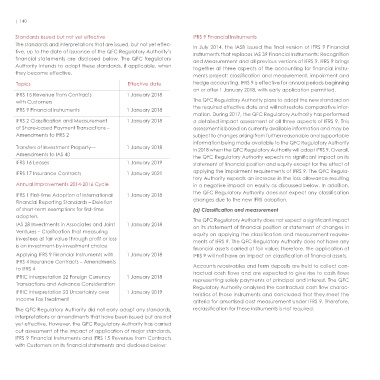

Topics Effective date hedge accounting. IFRS 9 is effective for annual periods beginning (c) Hedge accounting SIC-15 Operating Leases-Incentives and SIC-27 Evaluating the Sub-

on or after 1 January 2018, with early application permitted.

IFRS 15 Revenue from Contracts 1 January 2018 The QFC Regulatory Authority is not involved in any hedge rela- stance of Transactions Involving the Legal Form of a Lease. IFRS 16

with Customers The QFC Regulatory Authority plans to adopt the new standard on tionship. Hence, changes related to the hedge accounting is not sets out the principles for the recognition, measurement, presen-

the required effective date and will not restate comparative infor- tation and disclosure of leases and requires lessees to account

IFRS 9 Financial Instruments 1 January 2018 applicable to the QFC Regulatory Authority.

mation. During 2017, the QFC Regulatory Authority has performed for all leases under a single on-balance sheet model similar to the

IFRS 2 Classification and Measurement 1 January 2018 a detailed impact assessment of all three aspects of IFRS 9. This (d) Expected impact accounting for finance leases under IAS 17.

of Share-based Payment Transactions – assessment is based on currently available information and may be The QFC Regulatory Authority estimates its transition impact to be

Amendments to IFRS 2 subject to changes arising from further reasonable and supportable approximately in the range of 0.25% to 0.30% of opening retained The standard includes two recognition exemptions for lessees

– leases of “low-value” assets (e.g., personal computers) and short-

information being made available to the QFC Regulatory Authority surplus on the date of initial application, as debit to net retained

Transfers of Investment Property— 1 January 2018 in 2018 when the QFC Regulatory Authority will adopt IFRS 9. Overall, term leases (i.e., leases with a lease term of 12 months or less).

Amendments to IAS 40 surpus resulting from expected credit losses on financial assets. At the commencement date of a lease, a lessee will recognise

the QFC Regulatory Authority expects no significant impact on its

IFRS 16 Leases 1 January 2019 statement of financial position and equity except for the effect of IFRS 15 Revenue from Contracts with Customers a liability to make lease payments (i.e., the lease liability) and an

asset representing the right to use the underlying asset during the

IFRS 17 Insurance Contracts 1 January 2021 applying the impairment requirements of IFRS 9. The QFC Regula- IFRS 15 was issued in May 2014, and amended in April 2016, and lease term (i.e., the right-of-use asset). Lessees will be required to

tory Authority expects an increase in the loss allowance resulting establishes a five-step model to account for revenue arising from

Annual Improvements 2014-2016 Cycle in a negative impact on equity as discussed below. In addition, contracts with customers. Under IFRS 15, revenue is recognised separately recognise the interest expense on the lease liability and

the QFC Regulatory Authority does not expect any classification at an amount that reflects the consideration to which an entity the depreciation expense on the right-of-use asset. Lessees will also

IFRS 1 First-time Adoption of International 1 January 2018 be required to re-measure the lease liability upon the occurrence

Financial Reporting Standards – Deletion changes due to the new IFRS adoption. expects to be entitled in exchange for transferring goods or services of certain events (e.g., a change in the lease term, a change in

of short-term exemptions for first-time (a) Classification and measurement to a customer. future lease payments resulting from a change in an index or rate

adopters The new revenue standard will supersede all current revenue used to determine those payments). The lessee will generally rec-

The QFC Regulatory Authority does not expect a significant impact

IAS 28 Investments in Associates and Joint 1 January 2018 on its statement of financial position or statement of changes in recognition requirements under IFRS. Either a full retrospective ognise the amount of the remeasurement of the lease liability as

Ventures – Clarification that measuring equity on applying the classification and measurement require- application or a modified retrospective application is required for an adjustment to the right-of-use asset.

investees at fair value through profit or loss ments of IFRS 9. The QFC Regulatory Authority does not have any annual periods beginning on or after 1 January 2018. Early adoption Lessor accounting under IFRS 16 is substantially unchanged from

is an investment-by-investment choice is permitted.

financial assets carried at fair value; therefore, the application of today’s accounting under IAS 17. Lessors will continue to classify all

Applying IFRS 9 Financial Instruments with 1 January 2018 IFRS 9 will not have an impact on classification of financial assets. In the QFC Regulatory Authority’s assessment, the fee income arising leases using the same classification principle as in IAS 17 and distin-

IFRS 4 Insurance Contracts – Amendments on application processing is non-refundable and will be recognised guish between two types of leases: operating and finance leases.

to IFRS 4 Accounts receivables and term deposits are held to collect con-

tractual cash flows and are expected to give rise to cash flows as income when received under IFRS 15. Annual license fees are IFRS 16 also requires lessees and lessors to make more extensive

IFRIC Interpretation 22 Foreign Currency 1 January 2018 representing solely payments of principal and interest. The QFC recognised as income on a straight line basis over the period to disclosures than under IAS 17. The QFC Regulatory Authority is cur-

Transactions and Advance Consideration which they relate. Service rendering under IFRS 15, which will con-

Regulatory Authority analysed the contractual cash flow charac- rently performing an initial assessment of the potential impact of

IFRIC Interpretation 23 Uncertainty over 1 January 2019 teristics of those instruments and concluded that they meet the tinue to be accounted for under the same basis as IAS 18 Revenue, the adoption of IFRS 16 on its financial statements.

Income Tax Treatment criteria for amortised cost measurement under IFRS 9. Therefore, is generally expected to have only one performance obligation.

The QFC Regulatory Authority did not early adopt any standards, reclassification for these instruments is not required. Considering the above, adoption of IFRS 15 is not expected to

interpretations or amendments that have been issued but are not have any impact on the QFC Regulatory Authority’s revenue and

yet effective. However, the QFC Regulatory Authority has carried profit or loss, when applied, on the financial statements of the QFC

out assessment of the impact of application of major standards, Regulatory Authority.

IFRS 9 Financial Instruments and IFRS 15 Revenue from Contracts

with Customers on its financial statements and disclosed below: