Page 25 - Annual Report 2022 EN

P. 25

/ 25 T ABLE OF C ONTENT S

Authorisation Anti-Money Laundering/Combating the Financing of Terrorism Supervision

The Authorisation department is responsible for AML/CFT Regulatory Framework FATF Mutual Evaluation National Risk Assessment

assessing and approving applications from firms and and Sectoral Risk Assessment

individuals seeking authorisation from the QFCRA to The QFCRA’s AML/CFT framework is based on Law FATF conducted a Mutual Evaluation (ME) of the

conduct regulated activities in or from the QFC. The No (20) of 2019 on Combatting Money Laundering State of Qatar in June 2022. Qatar’s report was The QFCRA continued to monitor any outputs from the

department also acts as the interface between and Terrorism Financing (AML/CFT Law) and the discussed at the FATF Plenary in February 2023, National Risk Assessment (NRA) in line with our Sectoral

applicants and the Companies Registration Office of the Implementing Regulations, and Law No (27) of 2019 with the outcome published in May 2023. Risk Assessment (SRA), noting no material risks were

QFC Authority regarding their licensing or incorporation Promulgating the Law on Combating Terrorism (CT identified that would cause any changes to our current

in the QFC. Law). These laws are supplemented by detailed The QFCRA’s AML/CFT team spent significant time risk-based assessment of our regulated population.

requirements under the Anti-Money Laundering and preparing for the evaluation, including updating

In 2022, the department met with prospective Combating the Financing of Terrorism Rules 2019 (AML/ the technical compliance and immediate outcome

applicants, reviewed their submitted regulatory business CFTR) for financial institutions (FIs) and designated responses. Based on the onsite assessment,

plans, and involved the Supervision department non-financial businesses and professions (DNFBPs), FATF did not identify any action items or areas

to ensure appropriate issues management after and the Anti-Money Laundering and Combating of improvement related to the QFCRA.

authorisation. During the year, 1 insurance company, the Financing of Terrorism (General Insurance)

1 captive insurance company, 2 fund managers, Rules 2019 (AMLG) for general insurance firms.

and 1 investment advisory firm were authorised. These rules align with Financial Action Task Force

(FATF) global recommendations and standards.

The number of individuals approved to perform

controlled functions at authorised firms increased In 2022, the QFCRA’s AML/CFT team continued

by 29 to 440 by year-end. implementing its 2021-2024 AML/CFT Strategic

Plan. The team supervised 98 firms (64 FIs and 34

DNFBPs), following a risk-based approach considering

Table 2: a firm’s activities, customers, and risk profile.

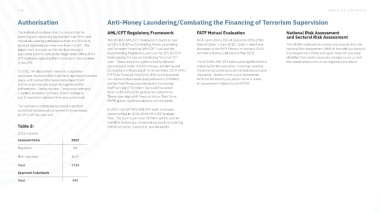

2022 statistics

Licenced Firms 2022

Regulated 64

Non-regulated 1670

Total 1734

Approved Individuals

Total 440