Page 22 - Annual Report 2022 EN

P. 22

/ 22 T ABLE OF C ONTENT S

The QFCRA’s Supervision and Authorisation division consists of the Authorisation, Financial Analysis and

Innovation (FAI), Bank and Insurance Supervision (BIS), Investment Manager, Advisor and Securities Supervision

(IMAS), and Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) Supervision departments.

Authorisation

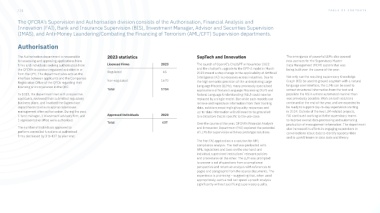

The Authorisation department is responsible 2023 statistics SupTech and Innovation The emergence of powerful LLMs also opened

for assessing and approving applications from new avenues for the Supervisory Master

firms and individuals seeking authorisation from Licenced Firms 2023 The launch of OpenAI’s ChatGPT in November 2022 Data Management (MDM) system that was

the QFCRA to conduct regulated activities in or and the chatbot’s upgrade to the GPT-4 model in March being built over the course of the year.

Regulated 65 2023 meant a step change in the applicability of Artificial

from the QFC. The department also acts as the

interface between applicants and the Companies Intelligence (AI) in processes across industries. Due to Not only can the resulting supervisory Knowledge

Non-regulated 1670 the high semantic precision of the underpinning Large Graph (KG) be used to ground a system with a natural

Registration Office of the QFCA regarding their

licensing or incorporation in the QFC. Language Models (LLMs), many previously specialised language user interface, the LLMs can be used to

Total 1734 applications of Natural Language Processing (NLP) and extract structured information from the text and

In 2023, the department met with prospective Natural Language Understanding (NLU) could now be populate the KG in a more automated manner than

applicants, reviewed their submitted regulatory replaced by a single model. But while such models can was previously possible. Work on both solutions

business plans, and involved the Supervision retrieve and reproduce information from their training continued at the end of the year, and are expected to

departments to ensure appropriate issues data, solutions requiring high quality responses and be ready to support day-to-day supervision starting

management after authorisation. During the year, up-to-date information will still need to be grounded in 2024. Outside of the two LLM-related projects,

1 fund manager, 1 investment advisory firm, and Approved Individuals 2023 to a datastore that is specific to the use-case. FAI continued working with the supervisory teams

1 representative office were authorised. to improve overall data processing and automating

Total 437 Over the course of the year, QFCRA’s Financial Analysis production of management information. The department

The number of individuals approved to and Innovation Department (FAI) explored the potential also increased its efforts in engaging supervisors in

perform controlled functions at authorised of LLMs for supervision with two prototype solutions. conversations about data to identify opportunities

firms decreased by 3 to 437 by year-end.

and to upskill teams in data tools and theory.

The first FAI application is a solution for AML

compliance analysis. The tool was preloaded with

AML regulations and laws on the one hand and

individual supervised institutions’ relevant policies

and procedures on the other. The LLM was prompted

to answer a set of questions from a compliance

perspective and return an analysis with references to

pages and paragraphs from the source documents. The

experience is promising – suggesting that, when used

appropriately, such a tool can speed up such analysis

significantly without sacrificing supervisory quality.