Page 26 - Annual Report 2022 EN

P. 26

/ 26 T ABLE OF C ONTENT S

Anti-Money Laundering/Combating the Financing of Terrorism Supervision

AML/CFT Regulatory Framework FATF Mutual Evaluation

The QFCRA’s AML/CFT framework is based on Law FATF discussed the State of Qatar’s Mutual

No. (20) of 2019 on Combatting Money Laundering Evaluation (ME) during its Plenary in February 2023

and Terrorism Financing (AML/CFT Law) and the and published its report in May 2023, following

Implementing Regulations, and Law No. (27) of 2019 the on-site review conducted in June 2022.

Promulgating the Law on Combating Terrorism (CT

FATF stated: “Qatar has made substantive improvements

Law). These laws are supplemented by detailed

to its system to combat money laundering and

requirements under the Anti-Money Laundering and

terrorism financing and its technical compliance with

Combatting the Financing of Terrorism Rules 2019 (AML/

FATF requirements is very strong. However, Qatar

CFTR) for financial institutions (FIs) and designated

needs to make some major improvements, in its

non-financial businesses and professions (DNFBPs),

criminal justice response to terrorist financing”.

and the Anti-Money Laundering and Combating the

Financing of Terrorism (General Insurance) Rules

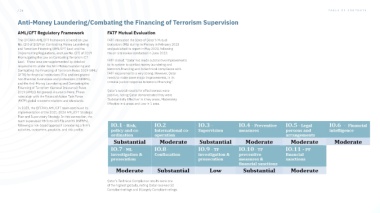

Qatar’s overall results for effectiveness were

2019 (AMLG) for general insurance firms. These

positive, noting Qatar demonstrated they were

rules align with the Financial Action Task Force

‘Substantially Effective’ in 4 key areas, Moderately

(FATF) global recommendations and standards.

Effective in 6 areas and Low in 1 area.

In 2023, the QFCRA’s AML/CFT team continued its

implementation of the 2021-2024 AML/CFT Strategic

Plan and Supervisory Strategy. In this connection, the

team supervised 98 firms (65 FIs and 33 DNFBPs),

following a risk-based approach considering a firm’s

activities, customers, products, and risk profile.

Qatar’s Technical Compliance results were one

of the highest globally, noting Qatar received 32

Compliant ratings and 8 Largely Compliant ratings.