Page 149 - Annual Report 2017

P. 149

| 148 149 |

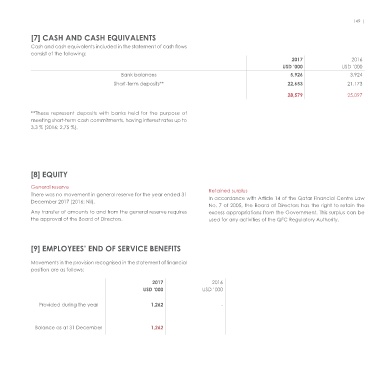

[6] ACCOUNTS RECEIVABLE AND PREPAYMENTS [7] CASH AND CASH EQUIVALENTS

2017 2016 Cash and cash equivalents included in the statement of cash flows

USD ‘000 USD ‘000 consist of the following:

2017 2016

Amount due from related parties - current 2,038 1,160

USD ‘000 USD ‘000

Prepaid expenses 457 466

Bank balances 5,926 3,924

Interest receivables 338 122 Short-term deposits** 22,653 21,173

Other receivables 76 73 28,579 25,097

2,909 1,821

Amount due from related parties classified as follows: **These represent deposits with banks held for the purpose of

meeting short-term cash commitments, having interest rates up to

2017 2016 3.3 % (2016: 2.75 %).

USD ‘000 USD ‘000

Current portion 2,038 1,160

Non-current portion* 1,262 -

Amount due from related parties (Note 13) 3,300 1,160

[8] EQUITY

* Effective from 1 January 2017, the QFC Regulatory Authority The same amount has been recognised as receivables from General reserve

resolved to recognise employee end of service benefit related lia- the Ministry of Administration based on a confirmation letter There was no movement in general reserve for the year ended 31 Retained surplus

bilities in the financial statements. As at 31 December 2017, USD received from the Ministry to compensate the QFC Regula- December 2017 (2016: Nil). In accordance with Article 14 of the Qatar Financial Centre Law

1,262 thousand has been recognised as provision for employee tory Authority for the payment of the end of service benefits. No. 7 of 2005, the Board of Directors has the right to retain the

end of service benefits. Any transfer of amounts to and from the general reserve requires excess appropriations from the Government. This surplus can be

the approval of the Board of Directors. used for any activities of the QFC Regulatory Authority.

There were no impaired accounts receivable as at 31 December

2017 (2016: Nil).

The ageing of unimpaired financial assets is as follows: [9] EMPLOYEES’ END OF SERVICE BENEFITS

Movements in the provision recognised in the statement of financial

Total Neither past due Past due but not impaired position are as follows:

USD ‘000 nor impaired 0 to 60 days 60 to 90 days > 90 days

USD ‘000 USD ‘000 USD ‘000 USD ‘000 2017 2016

2017 3,714 3,714 - - - USD ‘000 USD ‘000

2016 1,355 1,355 - - -

Provided during the year 1,262 -

Unimpaired financial assets are expected, on the basis of past

experience, to be fully recoverable. It is not the practice of the Balance as at 31 December 1,262

QFC Regulatory Authority to obtain collateral over receivables.