Page 153 - Annual Report 2017

P. 153

| 152 153 |

[14] FINANCIAL RISK MANAGEMENT Currency risk Liquidity risk

Currency risk is the risk that the fair value or future cash flows of Liquidity risk is the risk that the QFC Regulatory Authority is unable

The QFC Regulatory Authority’s financial liabilities comprise trade a financial instrument will fluctuate due to changes in foreign to meet its payment obligations associated with its financial lia-

payables and accrued expenses. The main purpose of these finan- exchange rates. The QFC Regulatory Authority’s principal business bilities that are settled by delivering cash or other financial assets

cial liabilities is to finance the QFC Regulatory Authority’s operations is conducted in United States Dollars and Qatari Riyals. As the Qatari when they fall due. The QFC Regulatory Authority limits its liquidity

and to provide guarantees to support its operations. The QFC Regu- Riyal is pegged to the United States Dollar, there is considered to risk by securing appropriations from the Government to finance its

latory Authority’s financial assets include interest receivables, other be minimal currency risk. operating and capital expenditure. The QFC Regulatory Authority’s

receivables, amount due from related parties, bank balances and terms of services require amounts to be paid within 30 days of the

cash that derive directly from its operations. Equity price risk date of service.

Equity price risk is the risk that the fair values of equities decrease

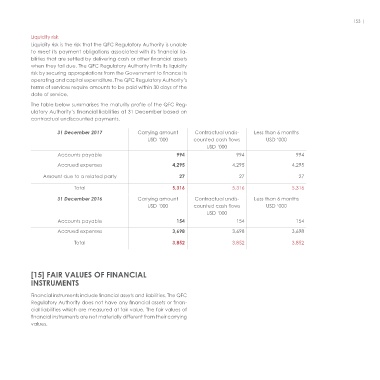

The QFC Regulatory Authority is exposed to market risk, credit risk as a result of changes in the levels of equity indices and the value The table below summarises the maturity profile of the QFC Reg-

and liquidity risk. The management has overall responsibility for of individual stocks. The QFC Regulatory Authority is not exposed ulatory Authority’s financial liabilities at 31 December based on

the establishment and oversight of the QFC Regulatory Authority’s to equity price risk since it does not hold any investment in equity contractual undiscounted payments.

risk management framework. The QFC Regulatory Authority’s risk instruments.

management policies are established to identify and analyse the 31 December 2017 Carrying amount Contractual undis- Less than 6 months

risks faced by the QFC Regulatory Authority, to set appropriate risk Credit risk USD ‘000 counted cash flows USD ‘000

limits and controls, and to monitor risks and adherence to limits. Risk Credit risk is the risk that one party to a financial instrument will USD ‘000

management policies and systems are reviewed regularly to reflect cause a financial loss for the other party by failing to discharge its Accounts payable 994 994 994

changes in market conditions and the QFC Regulatory Authority’s obligation. The QFC Regulatory Authority exposure to credit risk is

activities. indicated by the carrying values of its assets which consist princi- Accrued expenses 4,295 4,295 4,295

pally of bank balances, fees and other receivables. The carrying

This note presents information about the QFC Regulatory Authority’s amount of financial assets represents the maximum credit exposure. Amount due to a related party 27 27 27

exposure to each of the above risks. Further quantitative disclosures Total 5,316 5,316 5,316

are included throughout these financial statements. The maximum exposure to credit risk at the reporting date was:

31 December 2016 Carrying amount Contractual undis- Less than 6 months

USD ‘000 counted cash flows USD ‘000

Market risk 2017 2016 USD ‘000

Market risk is the risk that changes in market prices, such as interest USD ‘000 USD ‘000 Accounts payable 154 154 154

rates and foreign currency exchange rates, will affect the profit or Interest receivables 338 122

the value of its holdings of financial instruments. The objective of Accrued expenses 3,698 3,698 3,698

market risk management is to manage and control the market risk Other receivables 76 73 Total 3,852 3,852 3,852

exposure within acceptable parameters, while optimising return.

Amount due from related parties 3,300 1,160

Bank balances 28,579 25,097

Interest rate risk

Interest rate risk is the risk that the fair value or future cash flows of 32,293 26,452 [15] FAIR VALUES OF FINANCIAL

a financial instrument will fluctuate due to changes in market inter- INSTRUMENTS

est rates. The QFC Regulatory Authority is not exposed to interest Credit risk in respect of bank balances is limited as the QFC

rate risk on its interest bearing assets (bank deposits) as the interest Regulatory Authority only deals with highly reputable banks in Qatar Financial instruments include financial assets and liabilities. The QFC

rate on bank deposits is fixed. The statement of comprehensive and abroad. Regulatory Authority does not have any financial assets or finan-

income and equity is not sensitive to the effect of reasonable pos- cial liabilities which are measured at fair value. The fair values of

sible changes in interest rates, with all other variables held constant, financial instruments are not materially different from their carrying

as the QFC Regulatory Authority does not hold any floating rate values.

financial assets or financial liabilities at the reporting date.