Page 110 - Annual Report 2019

P. 110

107 ANNUAL REPORT 2019 QFC REGULATORY AUTHORITY FINANCIAL STATEMENTS

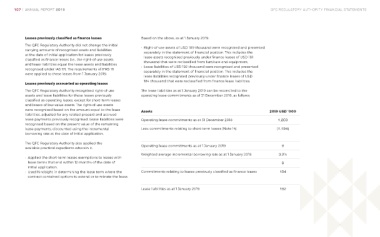

Leases previously classified as finance leases Based on the above, as at 1 January 2019:

The QFC Regulatory Authority did not change the initial • Right-of-use assets of USD 189 thousand were recognised and presented

carrying amounts of recognised assets and liabilities separately in the statement of financial position. This includes the

at the date of initial application for leases previously lease assets recognised previously under finance leases of USD 181

classified as finance leases (i.e., the right-of-use assets thousand that were reclassified from furniture and equipment.

and lease liabilities equal the lease assets and liabilities • Lease liabilities of USD 192 thousand were recognised and presented

recognised under IAS 17). The requirements of IFRS 16 separately in the statement of financial position. This includes the

were applied to these leases from 1 January 2019.

lease liabilities recognised previously under finance leases of USD

184 thousand that were reclassified from finance lease liabilities.

Leases previously accounted as operating leases

The QFC Regulatory Authority recognised right-of-use The lease liabilities as at 1 January 2019 can be reconciled to the

assets and lease liabilities for those leases previously operating lease commitments as of 31 December 2018, as follows:

classified as operating leases, except for short-term leases

and leases of low-value assets. The right-of-use assets

were recognised based on the amount equal to the lease Assets 2019 USD ‘000

liabilities, adjusted for any related prepaid and accrued

lease payments previously recognised. Lease liabilities were Operating lease commitments as at 31 December 2018 1,203

recognised based on the present value of the remaining

lease payments, discounted using the incremental Less: commitments relating to short-term leases (Note 14) (1,194)

borrowing rate at the date of initial application.

The QFC Regulatory Authority also applied the

available practical expedients wherein it: Operating lease commitments as at 1 January 2019 9

Weighted average incremental borrowing rate as at 1 January 2019 3.2%

• Applied the short-term leases exemptions to leases with

lease terms that end within 12 months of the date of 8

initial application.

• Used hindsight in determining the lease term where the Commitments relating to leases previously classified as finance leases 184

contract contained options to extend or terminate the lease.

Lease liabilities as at 1 January 2019 192