Page 48 - Annual Report 2019

P. 48

45 ANNUAL REPORT 2019 SUPERVISION AND AUTHORISATION

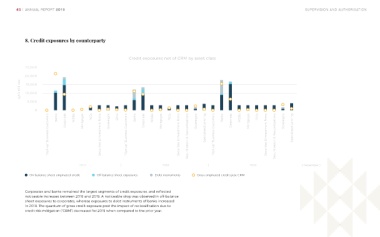

8. Credit exposures by counterparty

Credit exposures net of CRM by asset class

QAR Millions

“Opt-up” Business Customers Banks Corporate MDBs Mortgages PSEs Securities & Investment Firms Sovereigns SPVs “Opt-up” Business Customers Banks Corporate MDBs Mortgages PSEs Securities & Investment Firms Securitisation & Rescuritisations Sovereigns Specialised Lending “Opt-up” Business Customers Banks Corporate MDBs Mortgages PSEs Securities & Investment Firms Securitisation & Rescuritisations Sovereigns Specialised Lending

2017 2018 2019 ( December )

On-balance sheet originated credit Off-balance sheet exposures Debt instruments Gross originated credit post CRM

Corporates and banks remained the largest segments of credit exposures, and reflected

noticeable increases between 2018 and 2019. A noticeable drop was observed in off-balance

sheet exposures to corporates, whereas exposures to debt instruments of banks increased

in 2019. The quantum of gross credit exposure post the impact of reclassification due to

credit risk mitigation (“CRM”) decreased for 2019 when compared to the prior year.