Page 54 - Annual Report 2019

P. 54

51 ANNUAL REPORT 2019 SUPERVISION AND AUTHORISATION

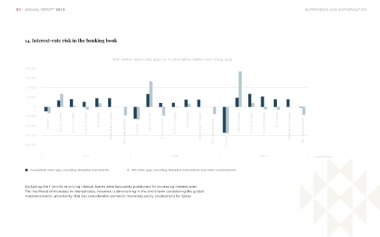

14. Interest-rate risk in the banking book

Net static repricing gap Vs Cumulative static repricing gap

1 month 1 to 3 months 3 to 6 months 6 to 12 months 1 to 10 years More than 10 years Non-rate sensitive 1 month 1 to 3 months 3 to 6 months 6 to 12 months 1 to 10 years More than 10 years Non-rate sensitive 1 to 3 months 3 to 6 months 6 to 12 months 1 to 10 years More than 10 years Non-rate sensitive

2017 2018 1 month 2019 ( December )

Cumulative static gap, including derivative instruments Net static gap, including derivative instruments and other commitments

Excluding the 1-month re-pricing interval, banks were favourably positioned for increasing interest rates.

The likelihood of increases in interest rates, however, is diminishing in the short-term considering the global

macroeconomic uncertainty that has considerable domestic monetary policy implications for Qatar.