Page 55 - Annual Report 2017

P. 55

| 54 55 |

a. Corporate Banks

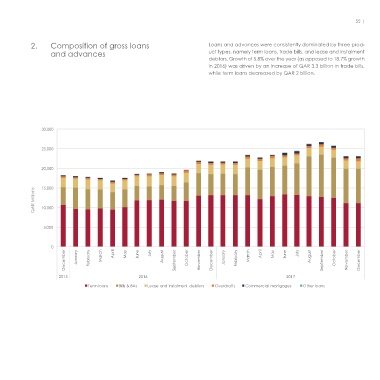

1. Composition of total assets The corporate banking sector’s total assets of QAR 31.8 billion 2. Composition of gross loans Loans and advances were consistently dominated by three prod-

reflected annual growth of 7.1% from December 2016 to Decem- and advances uct types, namely term loans, trade bills, and lease and instalment

ber 2017 compared to the increase of 28.6% in the prior year. While debtors. Growth of 5.8% over the year (as opposed to 18.7% growth

loans and advances remained the dominant component, ending in 2016) was driven by an increase of QAR 3.3 billion in trade bills,

at 72% of the total assets, balances with other banks rose from 18.4% while term loans decreased by QAR 2 billion.

to 21.9%. Investments decreased from 7.7% to 5.7%.

40,000 30,000

35,000

25,000

30,000

20,000

25,000

20,000 15,000

QAR Millions 15,000 QAR Millions 10,000

10,000

5,000 5,000

0 July July 0

December January February March April May June August September October November December January February March April May June August September October November December December January February March April May June July August September October November December January February March April May June July August September October November December

2015 2016 2017

2015 2016 2017

Loans & advances Balances with other banks Investments ST securities Derivatives Other Cash & central bank balances

Term loans Bills & BAs Lease and instalment debtors Overdrafts Commercial mortgages Other loans