Page 59 - Annual Report 2017

P. 59

| 58 59 |

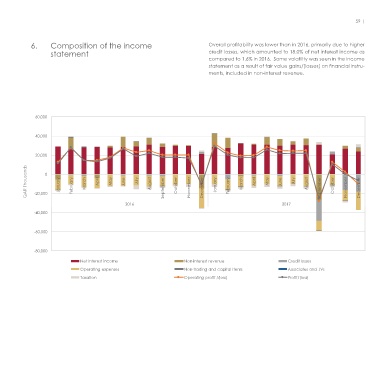

5. Composition of off-balance Off-balance sheet activities fell by a further 25.8% after the 30.1% 6. Composition of the income Overall profitability was lower than in 2016, primarily due to higher

sheet activities decline in the prior year. Performance-related guarantees, which statement credit losses, which amounted to 18.0% of net interest income as

drove the prior year decrease, were fairly consistent in 2017, while compared to 1.6% in 2016. Some volatility was seen in the income

unutilised facilities granted and direct credit substitutes contributed statement as a result of fair value gains/(losses) on financial instru-

most to the current year’s drop. ments, included in non-interest revenue.

10,000 60,000

9,000

40,000

8,000

7,000

20,000

6,000

5,000

QAR Millions 4,000 QAR Thousands -20,000 0 January February March April May June July August September October November December January February March April May June July August September October November December

3,000

2016 2017

2,000

-40,000

1,000

0 -60,000

December January February March April May June July August September October November December January February March April May June July August September October November December -80,000

2015 2016 2017 Net interest income Non-interest revenue Credit losses

Performance-related Direct credit substitutes Other commitments Trade-related Other Contingencies Operating expenses Non-trading and capital items Associates and JVs

Taxation Operating profit /(loss) Profit/(loss)