Page 63 - Annual Report 2017

P. 63

| 62 63 |

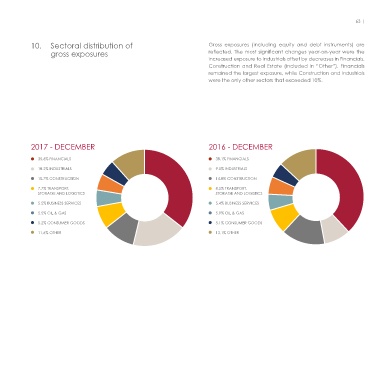

9. Classified credit Classified credit, which rose from 0.6% to 1.9% of gross loans and 10. Sectoral distribution of Gross exposures (including equity and debt instruments) are

advances in 2017, continued to be dominated by the Special Men- gross exposures reflected. The most significant changes year-on-year were the

tion category. The coverage ratios increased from the April lows increased exposure to Industrials offset by decreases in Financials,

to end the year at 17.5% by specific provisions and 20.6% by total Construction and Real Estate (included in “Other”). Financials

provisions. remained the largest exposure, while Construction and Industrials

were the only other sectors that exceeded 10%.

600 40.0%

35.0%

500

2017 - DECEMBER 2016 - DECEMBER

30.0%

35.6% FINANCIALS 38.1% FINANCIALS

400

25.0% 18.2% INDUSTRIALS 9.0% INDUSTRIALS

10.7% CONSTRUCTION 14.8% CONSTRUCTION

7,7% TRANSPORT,

8.5% TRANSPORT,

QAR Millions 300 20.0% STORAGE AND LOGISTICS STORAGE AND LOGISTICS

5.4% BUSINESS SERVICES

5.5% BUSINESS SERVICES

200 15.0% 5.5% OIL & GAS 5.9% OIL & GAS

5.2% CONSUMER GOODS 5.1% CONSUMER GOODS

10.0%

11.6% OTHER 13.1% OTHER

100

5.0%

0 0.0%

Special mention Substandard Loss Specific coverage ratio Total coverage ratio