Page 68 - Annual Report 2017

P. 68

| 68 69 |

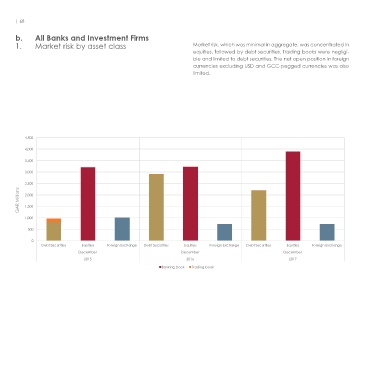

b. All Banks and Investment Firms

1. Market risk by asset class Market risk, which was minimal in aggregate, was concentrated in 2. Foreign exchange exposures The net open position in foreign currencies was dominated by the

equities, followed by debt securities. Trading books were negligi- (net open position) Turkish Lira, included in “Other”. Approximately half of the physical

ble and limited to debt securities. The net open position in foreign long positions were hedged, which also accounts for the decrease

currencies excluding USD and GCC-pegged currencies was also and subsequent increase in “Other”.

limited.

4,500 700

4,000 600

3,500 500

3,000 400

2,500 300

QAR Millions 2,000 QAR Millions 200

1,500

1,000 100

0

500

(100)

0

Debt Securities Equities Foreign Exchange Debt Securities Equities Foreign Exchange Debt Securities Equities Foreign Exchange

(200)

December December December

December-15 September-16 November-16 December-16 September-17 November-17 December-17

2015 2016 2017 April-16 May-16 June-16 July-16 April-17 May-17 June-17 July-17

Banking book Trading book January-16 February-16 March-16 August-16 October-16 January-17 February-17 March-17 August-17 October-17

EUR USD-pegged RMB INR JPY GBP Other