Page 71 - Annual Report 2017

P. 71

| 70 71 |

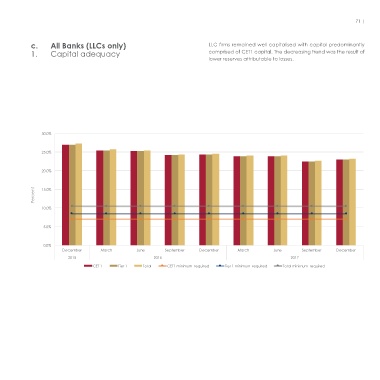

3. Assets under management As at December 2017, assets under management amounted to c. All Banks (LLCs only) LLC firms remained well capitalised with capital predominantly

QAR 44.1bn, a marginal decrease from QAR 45.6bn the year before 1. Capital adequacy comprised of CET1 capital. The decreasing trend was the result of

and well off the high of QAR 51.5bn in June 2015. Discretionary port- lower reserves attributable to losses.

folios were the dominant activity, with a fairly balanced distribution

between those managed inside and outside the QFC.

50

45 30.0%

40

25.0%

35

20.0%

30

QAR Billions 25 Percent 15.0%

20

10.0%

15

5.0%

10

0.0%

5 December March June September December March June September December

2015 2016 2017

0 CET 1 Tier 1 Total CET1 minimum required Tier 1 minimum required Total minimum required

Dec-15 Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17 Sep-17 Dec-17

Funds Under Management – Non QFC Fund Funds under Management – outside QFC

Discretionary Portfolio Management – in QFC Discretionary Portfolio Management – outside QFC