Page 75 - Annual Report 2017

P. 75

| 74 75 |

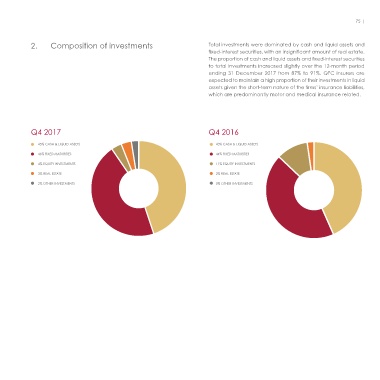

1. Composition of total assets The composition of total assets of the insurance sector has remained 2. Composition of investments Total investments were dominated by cash and liquid assets and

fairly consistent and was dominated by cash and other investments. fixed-interest securities, with an insignificant amount of real estate.

The reduction in the total assets in the third quarter of 2017 reflects The proportion of cash and liquid assets and fixed-interest securities

the insurance portfolio transfer conducted by QIC International LLC to total investments increased slightly over the 12-month period

as part of the firm’s de-authorisation process. ending 31 December 2017 from 87% to 91%. QFC insurers are

expected to maintain a high proportion of their investments in liquid

assets given the short-term nature of the firms’ insurance liabilities,

which are predominantly motor and medical insurance related.

Q4 2017 Q4 2016

6,000

45% CASH & LIQUID ASSETS 43% CASH & LIQUID ASSETS

46% FIXED MATURITIES 44% FIXED MATURITIES

5,000

4% EQUITY INVESTMENTS 11% EQUITY INVESTMENTS

3% REAL ESTATE 2% REAL ESTATE

4,000 2% OTHER INVESTMENTS 0% OTHER INVESTMENTS

QAR Millions 3,000

2,000

1,000

-

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017

Cash & liquid assets Other investments Reinsurance receivables Premiums receivables Other assets