Page 128 - Annual Report 2020

P. 128

/ 123 QF CR A ANNU AL REP OR T 2020

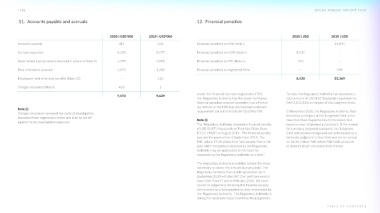

11. Accounts payable and accruals 12. Financial penalties

2020 | USD’000 2019 | USD’000 2020 | USD 2019 | USD

Accounts payable 481 504 Financial penalties on FAB (Note i) - 54,870

Accrued expenses 4,225 5,077 Financial penalties on HCW (Note ii) 8,230 -

Government appropriations received in advance (Note 2) 1,279 2,615 Financial penalties on TIC (Note iii) 200 -

Fees received in advance 1,170 1,283 Financial penalties on registered firms - 499

Employees’ end of service benefits (Note 10) - 145 8,430 55,369

Charges recovered (Note i) 418 5

Under the Financial Services Regulations (FSR), To date, the Regulatory Authority has recovered a

7,573 9,629

the Regulatory Authority has the power to impose total amount of USD 852 thousands (equivalent to

financial penalties where it considers that a Person QAR 3,100,315) in respect of the Judgment Debt.

(as defined in the FSR) has contravened a relevant

Note (i)

requirement set out in Article 84 (1) of the FSR. In November 2020, the Regulatory Authority, filed

Charges recovered represent the costs of investigation

its motion in respect of the Judgment Debt in the

recovered from registered entities and is to be set off

Note (i) New York State Supreme Court (the state’s first-

against future investigation expenses.

The Regulatory Authority imposed a financial penalty instance court of general jurisdiction). If the motion

of USD 54,870 thousands on First Abu Dhabi Bank for summary judgment succeeds, the Judgment

P.J.S.C (“FAB”) in August 2019. The financial penalty Debt will become recognised and enforceable as a

was due for payment on 4 September 2019. The domestic judgment in New York and can be served

FSR, article 59 (4) states that “any penalty that is not on banks in New York where FAB holds accounts

paid within the period stipulated by the Regulatory in order to attach the assets held therein.

Authority may on application to the Court be

recovered by the Regulatory Authority as a debt”.

The Regulatory Authority is entitled to take the steps

necessary to collect the amount due as a debt. The

Regulatory Authority filed a debt application on 9

September 2019 with the QFC Civil and Commercial

Court (the “Court”) and in February 2020, the court

issued its judgement declaring the financial penalty

with interest as a debt payable to, and recoverable by,

the Regulatory Authority. The Regulatory Authority is

taking the necessary steps to enforce the judgement.

T ABLE OF C ONTENT S