Page 132 - Annual Report 2020

P. 132

/ 127 QF CR A ANNU AL REP OR T 2020

Credit risk

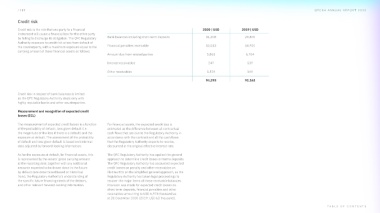

Credit risk is the risk that one party to a financial 2020 | USD 2019 | USD

instrument will cause a financial loss for the other party

Bank balances including short-term deposits 31,308 29,800

by failing to discharge its obligation. The QFC Regulatory

Authority exposure to credit risk arises from default of

Financial penalties receivable 55,553 54,921

the counterparty, with a maximum exposure equal to the

carrying amount of these financial assets as follows:

Amount due from related parties 5,861 6,764

Interest receivables 247 537

Other receivables 1,324 140

94,293 92,162

Credit risk in respect of bank balances is limited

as the QFC Regulatory Authority deals only with

highly reputable banks and other counterparties.

Measurement and recognition of expected credit

losses (ECL)

The measurement of expected credit losses is a function For financial assets, the expected credit loss is

of the probability of default, loss given default (i.e. estimated as the difference between all contractual

the magnitude of the loss if there is a default) and the cash flows that are due to the Regulatory Authority in

exposure at default. The assessment of the probability accordance with the contract and all the cash flows

of default and loss given default is based on historical that the Regulatory Authority expects to receive,

data adjusted by forward-looking information. discounted at the original effective interest rate.

As for the exposure at default, for financial assets, this The QFC Regulatory Authority has applied the general

is represented by the assets’ gross carrying amount approach to determine credit losses on terms deposits.

at the reporting date; together with any additional The QFC Regulatory Authority has accounted expected

amounts expected to be drawn down in the future credit losses on penalty and other receivables on

by default date determined based on historical lifetime ECL on the simplified general approach, as the

trend, the Regulatory Authority’s understanding of Regulatory Authority has taken legal proceedings to

the specific future financing needs of the debtors, recover the major items of these receivable balances.

and other relevant forward-looking information. Provision was made for expected credit losses on

short-term deposits, financial penalties and other

receivables amounting to USD 6,974 thousand as

at 31 December 2020 (2019: USD 63 thousand).

T ABLE OF C ONTENT S