Page 99 - Annual Report 2017

P. 99

| 98 99 |

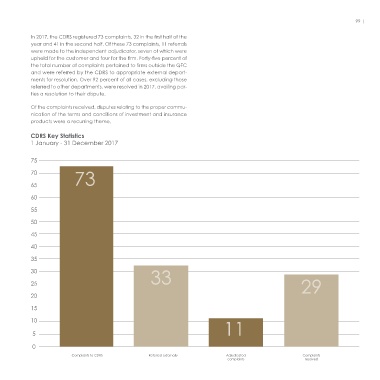

The Customer Dispute Resolution Scheme In 2017, the CDRS registered 73 complaints, 32 in the first half of the

year and 41 in the second half. Of these 73 complaints, 11 referrals

The promotion and maintenance of confidence in the QFC is a key were made to the independent adjudicator, seven of which were

objective for the Regulatory Authority. A core part of this objec- upheld for the customer and four for the firm. Forty-five percent of

tive is the provision of an appropriate and effective consumer the total number of complaints pertained to firms outside the QFC

protection programme. The Customer Dispute Resolution Scheme and were referred by the CDRS to appropriate external depart-

(CDRS) forms part of the consumer protection programme and is ments for resolution. Over 92 percent of all cases, excluding those

a process designed to resolve disputes between customers and referred to other departments, were resolved in 2017, availing par-

authorised firms in the Qatar Financial Centre. It is open to all retail ties a resolution to their dispute.

and individual customers of QFC authorised firms and is available

if the customer is unable to resolve the dispute directly with the firm Of the complaints received, disputes relating to the proper commu-

through its internal complaints system. nication of the terms and conditions of investment and insurance

products were a recurring theme,

Most complaints are resolved directly with the firm but where this

has not been possible, the CDRS provides a process whereby the

dispute can be considered by an independent adjudicator, who

will make an adjudication which is binding on the firm. The Regula-

tory Authority has an administrative role in this process that includes

ensuring the delivery of a fair, efficient, cost-effective, transparent

and timely process.

The Customer Dispute Resolution Scheme process is illustrated right: