Page 36 - Annual Report 2021 EN

P. 36

/ 36 T ABLE OF C ONTENT S

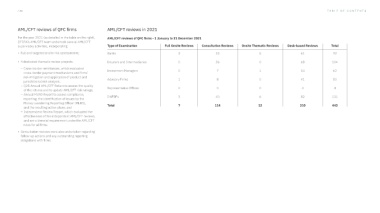

AML/CFT reviews of QFC firms AML/CFT reviews in 2021

For the year 2021 (as detailed in the table on the right), AML/CFT reviews of QFC firms - 1 January to 31 December 2021

QFCRA’s AML/CFT team undertook several AML/CFT

supervisory activities, incorporating: Type of Examination Full Onsite Reviews Consultation Reviews Onsite Thematic Reviews Desk-based Reviews Total

• Full and targeted onsite risk assessments; Banks 3 23 5 61 92

• 4 dedicated thematic review projects: Insurers and Intermediaries 0 36 0 68 104

– Cross-border remittances, which evaluated

Investment Managers 0 7 1 54 62

cross-border payment mechanisms and firms’

risk mitigation and application of product and

Advisory Firms 1 8 0 41 50

jurisdictional risk analysis;

– Q25 Annual AML/CFT Return to assess the quality

Representative Offices 0 0 0 4 4

of the returns and to update AML/CFT risk ratings;

– Annual MLRO Report to assess compliance,

DNFBPs 3 40 6 82 131

reporting, the identification of issues by the

Money Laundering Reporting Officer (MLRO),

Total 7 114 12 310 443

and the resulting action plans; and

– Independent Review Report, which evaluated the

effectiveness of the independent AML/CFT reviews,

and are a biennial requirement under the AML/CFT

rules for all firms.

• Consultation reviews were also undertaken regarding

follow-up actions and any outstanding reporting

obligations with firms.