Page 77 - Annual Report 2019

P. 77

74 ANNUAL REPORT 2019 POLICY AND ENFORCEMENT

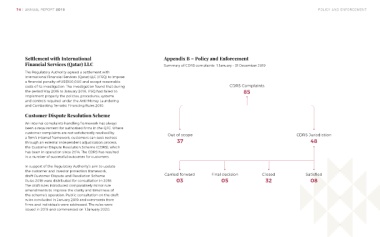

Settlement with International Appendix B – Policy and Enforcement

Financial Services (Qatar) LLC Summary of CDRS complaints 1 January – 31 December 2019

The Regulatory Authority agreed a settlement with

International Financial Services (Qatar) LLC (IFSQ) to impose

a financial penalty of US$100,000 and accept reasonable

costs of its investigation. The investigation found that during CDRS Complaints

the period May 2016 to January 2018, IFSQ had failed to 85

implement properly the policies, procedures, systems

and controls required under the Anti-Money Laundering

and Combatting Terrorist Financing Rules 2010.

Customer Dispute Resolution Scheme

An internal complaints-handling framework has always

been a requirement for authorised firms in the QFC. Where

customer complaints are not satisfactorily resolved by Out of scope CDRS Jurisdiction

a firm’s internal framework, customers can seek redress

through an external independent adjudication process, 37 48

the Customer Dispute Resolution Scheme (CDRS), which

has been in operation since 2014. The CDRS has resulted

in a number of successful outcomes for customers.

In support of the Regulatory Authority’s aim to update

the customer and investor protection framework,

draft Customer Dispute and Resolution Scheme Carried forward Final decision Closed Satisfied

Rules 2018 were distributed for consultation in 2018. 03 05 32 08

The draft rules introduced comparatively minor rule

amendments to improve the clarity and timeliness of

the scheme’s operation. Public consultation on the draft

rules concluded in January 2019 and comments from

firms and individuals were addressed. The rules were

issued in 2019 and commenced on 1 January 2020.